Fiverr’s Q3 2023 results showed that the freelance marketplace is continuing its upward trajectory, brushing aside the doubts of any naysayers on Wall Street and the threat of AI. But what do the numbers mean for the bedrock of Fiverr’s success: its vast talent pool of sellers?

NOTE: This article focuses more on interpreting the impact of Fiverr’s decisions during Q3 2023 on sellers rather than offer insights into the current financial record of Fiverr. While there is some reference to key statistics, these are used to support my personal opinions and assertions, rather than offered as any kind of expert financial reporting. I also do not own any stock in Fiverr.

As 2023 draws closer to its end, Fiverr’s latest financial results (released on November 9th) paint a picture that goes far beyond numbers, reflecting the seismic changes of AI in the quicksand of an ever-shifting digital landscape.

Whether you’re a veteran Fiverr seller like me, a Fiverr investor interested in the view from the ‘trenches’, or just starting out on the platform, we have all noticed the disruption of artificial intelligence. Fiverr’s Q3 2023 results aren’t just a report card on how the freelance platform is performing; they are also a clear indication of a company adapting to change by embracing AI and maintaining focus on bigger and better marketplaces.

Over the past decade, I’ve spent countless hours fine-tuning my services to meet the demands of Fiverr and its buyers. Fiverr’s financial reports are more than just figures to me, but the pulse of a community I’m invested in professionally and personally.

Every quarter, I have just one question: “What does any of this mean for Fiverr sellers – and what can I do about it?”

Key Takeaways

- Fiverr’s revenue grew 12% year-over-year to $92.5 million in Q3 2023, showing the platform’s financial health and upward trajectory despite challenges.

- The number of active buyers dipped 2% but the average spend per buyer increased by 4% to $271, indicating that buyers are seeking higher quality services.

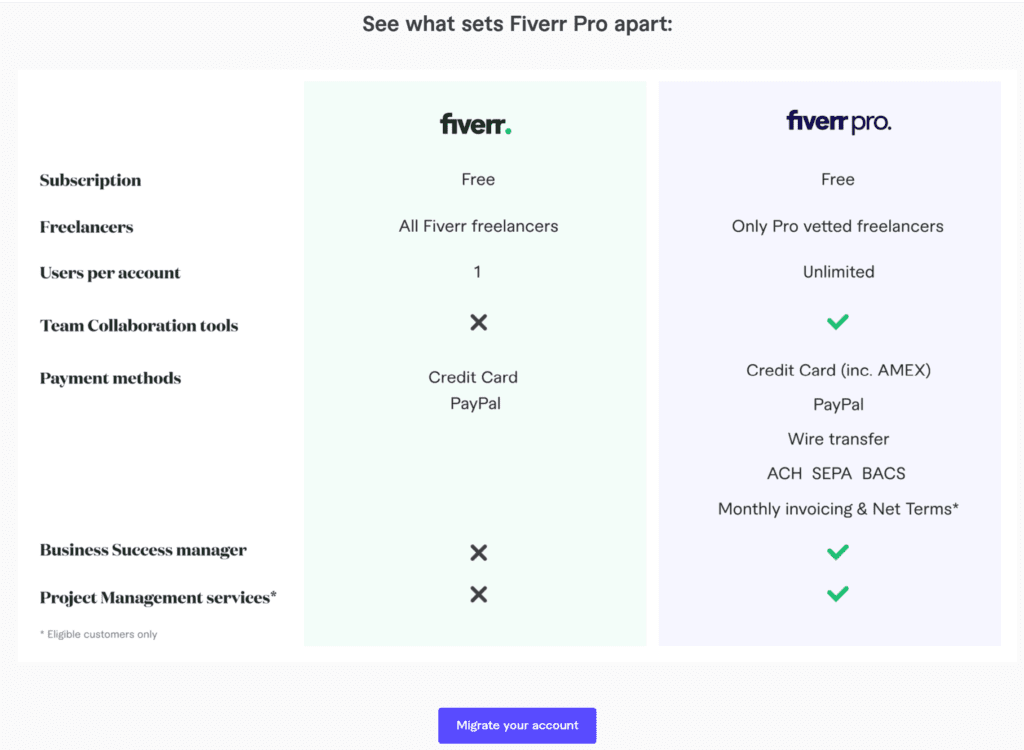

- Fiverr continues moving upmarket, focusing on premium services and bigger projects rather than cheap gigs. This benefits established high-quality sellers.

- Seller Plus now has over 25,000 subscribers, thanks to features like advanced analytics.

- Promoted Gigs was introduced to the new Fiverr Pro marketplace, potentially explaining the recent issues sellers have experienced with the platform’s advertising feature.

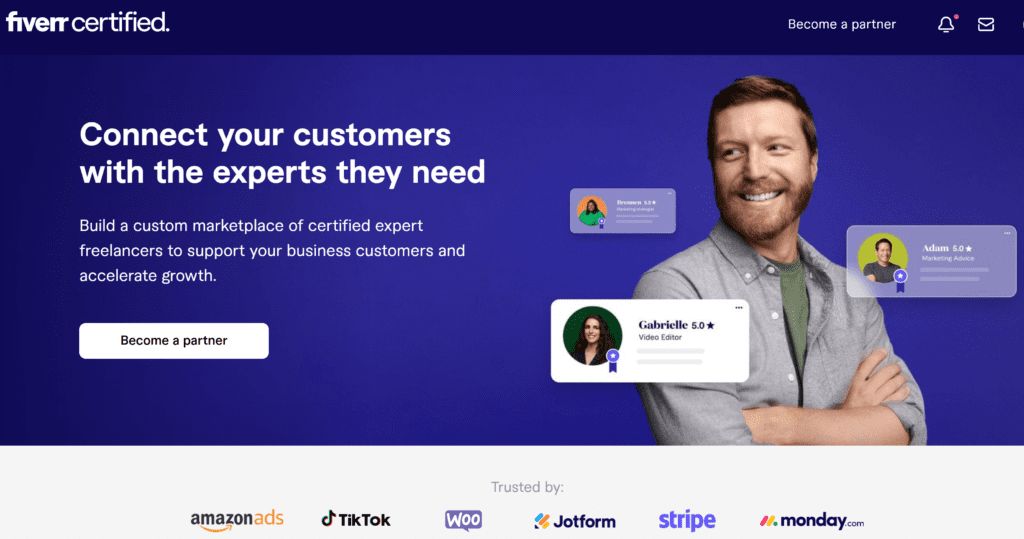

- The new Fiverr Certified marketplace connects expert sellers with tech partners such as JotForm and Wishpond; early deals show promise.

- Pro Verified sellers can land big ticket sales, with a $50,000+ project noted between one seller and a social media company.

- Top sellers should keep focusing on service quality, metrics, and customer service to stay competitive as Fiverr evolves.

Key Seller Numbers: Fiverr Q3 2023 Results

- $92.5 million revenue (up 12% from 3Q 2022)

- 4.2 million buyers (down 2% year-on-year)

- $271 average spend per buyer (up 4% year-on-year)

- Over 25,000 active Seller Plus subscribers

- Promoted Gigs introduced to Fiverr Pro marketplace

- Increased focus on brand expansion into non-English marketplaces

Fiverr’s Financial Health Is Robust in Q3 2023

One classic trope of the disgruntled Fiverr user is that Fiverr is failing financially. What else could explain the lack of sales and loss of revenue for so many sellers?

What else could explain the horrific quality of services that plague the lower end of the marketplace, even after going through the approval process in Q3 2023?

How could one otherwise understand Fiverr Customer Support’s unhelpful responses and inability to, well, support its users?

While some sellers may feel that Fiverr’s is on the verge of collapsing under its own greed and arrogance, the numbers in the Q3 2023 report just don’t agree with their assessment.

Fiverr’s Q3 2023 results once again confidently swat these doubts aside, telling a story of a company growing despite economic storms, industry upheaval, and local war. Confounding the gloomy prognoses of Wall Street’s Fiverr analyses that stuck the platform into the box of pandemic treats, it’s even thriving, with a 12% increase in revenue from the same quarter in 2022.

There’s just one blot on a very sunny spreadsheet: a 2% dip in active buyers. This decline might send a ripple of concern through investor circles, but it is balanced neatly with an increased average spend per buyer of 4% ($271) in Q3 2023.

Sure, there might be fewer buyers – but they’re spending more.

For sellers who are already established on Fiverr, this can only be good news: our various skills are more valued than ever before. We’re not just throwaway $5 trinkets in the rough taking care of dull and repetitive tasks, but professionals who help businesses to complete what can sometimes be their biggest projects to date.

Remember, 2023 was a year where Fiverr promised to focus on its premium marketplace and elite sellers more than ever. As the platform’s revenue has swelled to $92.5 million in Q3 2023, high quality sellers who have prioritized excellence in all areas are, for the most part, thriving.

There’s a reason for that.

Fiverr Continues Its Relentless Upmarket Ascent

Sometimes, online platforms reflect what their userbase wants. Sometimes, they drag their userbase kicking and screaming with them. With Fiverr, it has been a mixture of both, a reflection of its two marketplaces and the very different needs they serve. It’s a careful balance, and one where you can never make everyone happy.

Q3 2023 saw Fiverr continue its journey to the top, shrugging off the many little $5 millstone gigs that made it, instead focusing on bigger, better business. Not everyone is thrilled, least of all sellers who want to settle down in the lower reaches of the platform, but the strategic climb upward leaves no seller in any doubt: either you’re coming with us, or you’re not. Q3 2023 only shows Fiverr and its investors that it’s chosen the right path.

It’s true: despite all Fiverr’s work in Q3 2023, the company still doesn’t conjure up images of luxury and exclusivity. Perhaps it never will. But it’s not about turning a tugboat into a yacht. It’s about reaching buyers with more complex needs and deeper pockets. Fiverr’s still a tugboat, but it’s not afraid to pull its weight and beyond. It’s the swiss army knife of freelancing, and it knows it – and it never stops tweaking to increase its utility.

The launch of the Pro marketplace, complete with promises to prioritize the platform’s best, was a clear pivot upwards in Q3 2023. It wasn’t just ambitious. It was a calculated move that aligns with my own journey on the platform, starting at $5 in 2013, now frequently entertaining four-figure gigs as a writer.

It’s a thrill to meet these kinds of upscale clients, many of whom I wouldn’t have dreamed would contact me when I first signed up. It’s a powerful, personal signal that matches what the Q3 2023 quarterly report reveals: Fiverr’s buyer userbase is evolving.

Fiverr used to be seen as a last resort, a cheap Aladdin’s Cave where you mostly got what you paid for if things went wrong. These days? Q3 2023 sees a Fiverr that is slowly, but surely positioning itself as the platform that’s the first call for quality and professionalism for outsourcing work:

Fiverr Business Solutions.

The Fiverr Pro Marketplace.

Fiverr Certified.

What other magic business tricks lie in Fiverr’s sleeves, waiting to be revealed with a flash and a bang in Q4 2023 and beyond?

The Fiverr environment is changing all the time – and always focused on moving upwards. Q3 2023 could be an exhausting whirlwind for sellers at times, juggling their own business with the pace of Fiverr’s never-ending cascade of tweaks and demands. All this, while keeping a close eye on their metric performance, visible or not.

Like its seller base, Fiverr is seeking buyers who settle down and invest in relationships with sellers, rather than just passing through. But that needs everyone to pull their weight. The bad news is mostly for sellers catering towards the lower end of the marketplace in Q3 2023: not only is AI stealing away their clients, but Fiverr isn’t the welcoming place it once was for the cheapest and most cheerful sellers, with small order fees only underlining the platform’s message – that $75 should be the new starting point.

Is that unfair? Possibly. But why shouldn’t businesses welcome Fiverr’s drive to be bigger and better if it can pull them up? How many sellers found themselves magically promoted to Pro in late July and early August? Was it a surprise final recognition of their performance? Or a cynical move to fill up an otherwise bare Pro marketplace, formerly the preserve of sellers Fiverr deemed the global 1% of freelancers?

We’ll never know the truth, but one thing’s for sure. Those newly promoted sellers who couldn’t perform over Q3 2023 were dropped back to their old status as quickly as they were promoted.

The Growth of Seller Plus

We believe the [Seller Plus] program not only provides monetization for Fiverr, but more importantly, strengthens the loyalty and sophistication of our sellers, and in turn benefits our buyers with higher quality and more professional services on the platform.

P.6, Fiverr Q3 2023 Shareholder Letter

When Seller Plus was launched in 2021 as a subscription-based loyalty program that offered features like advanced analytics and customer engagement tools, I joined up immediately. Fiverr doesn’t always launch its new initiatives with huge fanfare, but they are always worth giving a shot. It didn’t hurt that as one of the first 200 to sign up, it would only be $19.99 a month in a lifetime deal until death (or the less severe cancellation option), either.

Two years later, I’ve never regretted the decision. It has empowered me to build my business, giving me access to metrics that hundreds of thousands of sellers don’t have. It hasn’t been as impactful as Pro, but it is something I would never willingly give up. As a Seller Plus Premium member (still $19.99), I have access to my own Success Manager when I need one. While I don’t find all of the features useful, I appreciate others do – and besides, who really uses all the features of every program they join?

It’s not surprising that the report reveals over 25,000 are now members at the end of Q3 2023. In such a competitive environment, every little edge counts. For ambitious sellers, it offers priority vetting for access to programs like Fiverr Pro and the much-coveted TRS (Top Rated Seller) levels. In its own way, it’s a mark of commitment from a seller about their commitment to succeeding on Fiverr.

The introduction of two-tier pricing in early 2023 only made access to this program even more democratic. Sure, it helped Fiverr increase its take to 31% in Q3 2023, and the lower tier does not have access to Success Managers. Despite this, more sellers than ever can give themselves an edge with tools like advanced keyword analytics and the program is highly accessible and frequently updated based on user feedback.

Fiverr’s commitment to continuing to deliver new features such as Pricing Insights only increases the value of this program, although for my personal tastes, many of these features are limited in scope. I suspect this may be because Fiverr doesn’t want to overpower the program too much. For various reasons, many sellers are not interested in Seller Plus. Maybe a killer future feature will change this, but for now, Fiverr does seemingly balance things out, and the program is firmly established. Fiverr really ramped up its features in Q3 2023, and I’m hoping the trend continues well into 2024. You can never have too many tools when it comes to Fiverr.

Promoted Gigs Go Pro: An Explanation for Recent Issues?

The benefits of advertisements in the business world hardly need to be explained, either from Fiverr’s side or the seller side, but it is worth touching on this point. In Q2 and Q3 2023, many sellers have reported that Promoted Gigs wasn’t working for them as well as before. Of all the seller issues in Q3 2023, this was one of the few that got sellers the most irate. Now they were paying to get no buyers? What was Fiverr doing?

While there was plenty of speculation as to why, Q3 2023 has been a rocky period for many freelancers – AI, lack of demand, and a dwindling buyer base being the most used – I believe that the expansion of Promoted Gigs to include Pro may have been the real reason. Sellers who grilled Customer Support about the issue were mostly stonewalled with nondescript explanations, which left many frustrated and discouraged – but still unwilling to sacrifice the advantage the feature gave them over others.

Another frustration was Fiverr’s increased focus on quality, with sellers losing access to Promoted Gigs due to a failure to meet the demands of largely unknown metrics – and Fiverr Customer Support unable to give clear answers. Was this due to Pro Verified sellers getting new priority, further enhancing Fiverr’s strategy of promoting only the best on the platform to its buyers in Q3 2023?

Personally, I have never used Promoted Gigs since I do not like the lack of fine-tuning its CPC model offers. It’s all very well paying for clicks, but I don’t want to be the spam in buyer inboxes, nor paying for spammers to find me. Still, many other sellers use the model and won’t give it up, even during times it doesn’t deliver. At the time of writing, the issues still persist, but Fiverr has no real financial incentive to adapt due to seller superstition about “giving up” their ranking if they quit.

Unfortunately, if sellers want to make changes, they need to try a different tack than they did in Q3 2023. Quit using Promoted Gigs and watch as the stock market furrows its eyebrows. Will it cow Fiverr into change? Maybe, maybe not. But since the marketplace is so competitive and its sellers so superstitious, Fiverr knows it has the upper hand.

This has helped Fiverr to boost its 31% take in Q3 2023, but at the same time, sellers in the regular marketplace may find that their own ROI continues to flounder. Remember, in August 2023, the company promised a clear shift in focus to supporting its Pro sellers and marketplaces more than ever over the course of Q3 2023 and beyond.

Even so, Fiverr’s competitiveness makes Promoted Gigs an attractive investment for most sellers. If everything else is equal to your nearest competitors, all that is left to do is grow visibility, and Promoted Gigs is a simple and neat way to do this, so long as your gig is what buyers want. That can be tough to know in the midst of Q3 2023’s disruptions, yet Promoted Gigs remains a good solution for those willing to put up with the program’s issues.

Fiverr Is Marketing Globally

Fiverr’s first focus was the English-speaking marketplace of North America, and that will never change. The United States has always been Fiverr’s biggest market, and that remained true in Q3 2023. One thing that has changed is Fiverr’s drive to expand into new global marketplaces to seize new opportunities. Sure, the American market continues to grow, but you know what’s faster? Doubling down on growth elsewhere.

The Q3 2023 Fiverr Report is clear: its marketing expeditions to France, Germany, and the Netherlands (among other countries) is succeeding. I’ve noticed more clients from outside the anglophone world. Fiverr’s localization efforts, celebrated at events like DMEXO 2023 are not just about basic translations for a new marketplace, but full on transformation with localizations to meet sensibilities and needs.

While English-speaking sellers may not think too much of this – the whole world speaks English, doesn’t it? – it does mean that the platform’s best should be adapting to even more diversity with a certain level of cultural intelligence embedded within our service from Q3 2023 onward. An ability to adjust to meet expectations of clients introduced via one of Fiverr’s local marketplaces can only enhance our ability to convert. Germany has always been the EU’s largest marketplace, Dutch people will always be more severe in their assessments of competency, and French people will always have a slight air of resentment that we’re not all speaking French.

But still, these markets all share one thing: they are in the West and they approach business with the same largely protestant ethic that North Americans do. Time should not be wasted, language should be courteously formal, and conduct should be professional and to the point. The bigger the budget, the more important the Western ideals of business dealings become, mostly transcending national borders while retaining a national flavor to spice up the subtext of any order.

For non-native English speaking sellers, many of whom are from Asia, it’s worth underlining the need to become familiar with the norms of international business English and professional behavior, especially if they want to become elite sellers on the platform. Small things, like simply saying nothing but “Hi” and waiting for a response before continuing, or even pursuing haggling tactics, are not culturally common in Western business, and generally unappreciated in Western business, where they are viewed as wasting the most precious commodity of all: time.

No matter where a buyer is from in the West, none will appreciate the approach.

Fiverr Certified Goes from Strength to Strength

Fiverr Certified, launched in June 2023, continues to go from strength to strength in Q3 2023 despite being one of Fiverr’s quieter 2023 launches. For those unfamiliar, this is a third complementary marketplace on Fiverr featuring vetted sellers who are experts in the use of one of Fiverr’s various Certified tech partners. Some of these partners include:

- Monday.com: An all-in-one work management platform for business

- Amazon: The world’s biggest ecommerce platform

- WooCommerce: An open-source ecommerce platform

- Paperform: An online form builder and form creator

- JotForm: An online form builder and form creator

- Wishpond: An all-in-one marketing platform

- Close CRM: A sales engagement CRM for SMBs

- AdCreative AI: A generative AI tool for advertising

In the report, Fiverr highlighted its ongoing commitment to improving this marketplace as one of the main themes of Q3 2023, highlighting the integration of the Amazon Ads pre-moderation API and plans to connect with even more partners for a broader marketplace scope.

This marketplace is still very young, but is working hard to meet its goal: of making up the shortcomings of the support teams of many SaaS vendors by leveraging the existing certified talent pool on Fiverr. The Swiss army knife of the freelance world is now a hyper-effective ZenDesk, offering affordable expertise that wants to help, rather than move onto the next ticket.

That sellers are already closing $3,000 deals with buyers in Q3 2023 is an indication that Fiverr Certified is going to be a major area of focus for growth in 2024. As a Fiverr Certified seller, I’m also excited about the potential of this program – there’s plenty of room for improvement and a dedicated team working to build something that doesn’t truly have an equivalent anywhere else in the freelance marketplace industry. TopTal is the closest competitor, but it lacks the breadth of talent that Fiverr can offer. To my mind, this makes it a significant area of promise.

Time will tell if that promise can be delivered on. Q3 2023 shows a lot of potential for the innovation, but the work has only just begun.

Fiverr Pro Verified Sellers Are in a Great Position

As a Pro Verified seller since 2017, there were no great surprises in the Q3 2023 report. Pro sellers are making more bigger ticket sales as Fiverr’s marketing outreach attracts more clients with bigger budgets. Fiverr highlighted one particular sale of over $50,000 between a Pro Verified Seller and a global social media company.

One of our largest transactions in Q3’23 was a $50,000+ order on Fiverr Pro where a global social media company needed help with digital marketing and publishing SEO-led articles across domains in nearly 30 countries.

P.7, Fiverr Q3 2023 Shareholder Letter

Even more excitingly, that was just one of the projects – although Fiverr didn’t disclose details for any other major Q3 2023 projects, it’s reasonable to assume that there were others that were in the same ballpark. For a company that started selling $5 gigs exclusively, this is an incredible milestone. Not just for the Pro marketplace, but also for the company’s own success in driving upmarket and connecting its talent to connect with some of the world’s biggest brands. It’s a note of success that makes Q3 2023 standout as one where Fiverr’s (and its sellers) hard work is starting to pay off.

This would have been unimaginable even just a few years ago, outside of ‘celebrity sellers’ like Jerry Media and Rob Janoff. Beyond Q3 2023, Fiverr may be home to even more big names as the platform achieves its aim grows in stature.

It just goes to demonstrate to sellers that the demand for AI over freelancers is not all-encompassing. As professionals in multiple industries have been pointing out all year, AI is only slaughtering the lambs at the bottom end of the marketplace in Q3 2023. The higher end of the marketplace remains largely unaffected, driven by quality over quantity.

AI even presents job opportunities, with Fiverr having introduced categories for AI artists and writers. Sellers at the lower end of the market are at risk of losing their jobs to AI, yet AI can still provide opportunities. However, the smarter move for these sellers is to upgrade their skills and service, reskilling into a more AI-resistant (or complementary) industry if necessary. If Q3 2023 wasn’t forgiving, neither will Q4 rolling into 2024 be either.

Another bright note for the lower end of the market? There are signs that, for now, the AI hype train might be slowing as buyers disembark, realizing that it ain’t all that. But I wouldn’t count on it.

Is the Fiverr Pro Marketplace Cannibalizing the Regular One?

It would be easy to think this with Fiverr’s overwhelming focus on its elite Fiverr Pro and Fiverr Certified marketplaces is cannibalizing its original one, but I don’t believe this is the case at all. Rather, in Q3 2023 and the future, the Pro marketplace acts as a complementary premium tier to the regular marketplace. It’s certainly true that buyers with larger budgets and need for project management tools would approach the Pro marketplace first – but that doesn’t mean they’re necessarily avoiding the regular marketplace.

After all, it’s not like the regular Fiverr marketplace has lost all traction and is unprofitable – far from it. What it does suffer from is high competition and buyers who are often far more demanding than the price they are paying for a service warrants. While the first isn’t necessarily bad for Fiverr, but the second can be, overloading Fiverr’s Customer Support with user battles over relatively trivial sums of money.

Instead, the Pro marketplace is for designed for buyers with bigger budgets and higher, but often more realistic expectations for projects given their budget and the vetted nature of the sellers they will hire. Are there still issues in Q3 2023? Of course, but speaking as someone who has been a Pro since 2017, Pro buyers are much more realistic with the demands and the budget they bring. So long as they pick the right talent, most jobs should go without any major hitches. This can only be good for overall buyer experience, increasing their trust and loyalty to the platform.

While many lower level sellers might complain about Fiverr’s apparent bias toward buyers in dispute, this is – in my opinion, at least – more of an issue for small gigs that create big problems where neither party has explicitly violated TOS. Fiverr’s Seller Protection Program does go some way to address this issue, but the best solution for sellers is to raise their prices. The vast majority of reported problem buyers on Fiverr are the cheap ones: pricing them out of range is a simple solution to the issue, so long as the seller has the skills and talent to back up that higher price point.

The problem goes both ways: some sellers simply should not be selling the services they offer due to incompetence. Their gigs, unvetted, affect buyer confidence in Fiverr badly while damaging its overall brand. Fiverr is making moves to clean up the regular marketplace, but it is taking the slow route with its ruthlessness. And, as prices go up, bad actors on both sides are forced out.

That may partially explain the loss of active buyers, but the uptick in average buyer spend to $271 reflects a 4% year-on-year increase in Q3 2023. That goes a long way to softening the perceived blow for Fiverr, if not for individual sellers who feel like the market has disappeared in front of their eyes. As more and more bad actors leave, there is definitely scope for increased buyer numbers, but this is a trend that needs to be tracked further.

Just like in the ‘real world’ some tasks will never be premium, such as data entry. In creating a two-tier marketplace where high quality, expert services, and professionalism is standard in one and more basic services are available in another, both can coexist without cannibalizing the userbase of the other too much.

After all, Fiverr still has its existing userbase of buyers who look for value more than the highest possible quality. Many repetitive, easy, but essential tasks have a natural price ceiling, no matter how large the project. However, it is these jobs that AI excels in – making them a bad starting point for a freelance career on Fiverr today. It is more viable that buyers with a bigger budget would hire an expert to set such AI systems up with either prompts or coding knowledge in one upfront investment cost rather than relying on a human team – and their potential for errors.

Still, for now, there are still some opportunities, such as categories like web development where Fiverr highlights momentum, but the opportunities continue to shrink as the AI industry continues its own meteoric growth trajectory. The message is clear for sellers that want to become a part of the platform’s elite group: sellers with in-demand, professional services who can offer elevated customer service can operate in both marketplaces – but everyone can benefit from the upmarket drive if they act strategically.

For those who can’t – or won’t – Fiverr is the least of their worries.

Fiverr Neo and the AI Revolution

Q3 2023 also saw the rollout of Fiverr Neo, the platform’s new matchmaking chatbot. The report highlights the story of a transport supplier who hired the first seller he matched with:

The buyer was able to express their specific needs, such as budget, programming language, and desired functionality, for developing an institutional, mobile-friendly website. The buyer then worked with the first seller that Neo™ recommended to perform the service.

P.8, Fiverr Q3 2023 Shareholder Letter

Compared to the damp squib of Brief and Match and the hellish pits of Buyer Requests, Fiverr Neo is revolutionary. While Fiverr has always used algorithms to matchmake, Neo might just be the secret sauce everyone using the platform is looking for: an algorithmic matchmaking system that actually works.

Fiverr Neo promises great things for sellers with carefully optimized profiles, hooking them up with clients who are ready to make a transaction. It’s something that no other freelance marketplace has. Take Upwork, instead focusing on reducing its standards by removing seller approval processes to increase its take on connects as people fight over scraps at the bidding table. Upwork has made some light efforts with integrating Grammarly and a beta Job Post Generator, but these features have largely been met with a critical reception. From my point of view, it seems that Upwork is focusing on the money to be made at the bottom end of the market as Fiverr tries to go in the opposite direction.

Adding onto Fiverr Neo, Fiverr is making technological advances in other areas. Fiverr Certified sellers in the Amazon program can now take advantage of the fresh integration of Amazon Ads’ pre-moderation API, making them more efficient.

Fiverr has always stated its commitment to reinvesting in its platform and improving the lot of its sellers. While many sellers consider the platform’s 20% commission to be too much, I think this is unfair. Upwork may be 10%, but innovation at and growth at Upwork appears to be moribund compared to Fiverr; after all, how much of Upwork’s growth is a result of its connects strategy, which doesn’t really help sellers, and almost certainly eats into the “cheaper” commission of 10%? Fiverr’s reinvestment efforts are, to me at least, a sign of a company that’s looking forward at solutions for growth in an uncertain future by using the tools of the future, rather than the tools of the past.

Only time can tell if this strategy will work, but from my vantage point and Fiverr’s Q3 2023 results, the promise is still there.

Seller Strategies Moving Forward From Q3 2023

Now that all of that is out of the way, what does any of this mean for ambitious or established sellers who want to progress on the platform? The 12% year-on-year increase in revenue to $92.5 million in Q3 2023 indicates that the marketplace is in rude health, but there are some nuances to consider.

Buyer Demographics are in Flux

Q3 2023 saw a slight 2% dip in buyer numbers, but their average spend has increased to $271. It might not seem much, but it’s a sign that buyers are shifting to value quality over quantity. This may be in part due to AI’s ability to do a lot of basic tasks, but not necessarily to a professional level of quality.

In the domain of writing, ChatGPT’s painful overuse of words like “delve” and “top-notch” persist without careful editing and prompting – and then there’s the tendency to hallucinate. The technology is certainly impressive, but the output often leaves a lot to be desired. For clients seeking unique copy that’s well-written, a professional writer is still the better investment, particularly if they are worried about potential AI penalties from Google.

The same story is echoed across many disciplines where generative AI is encroaching on creative spaces. For now, AI remains a prescient threat rather than an actual danger to elite sellers on Fiverr. Sellers at lower levels should be recalibrating their services toward attracting and retaining high-value clients or seeking jobs in other industries – nothing else will change their lot. Fiverr wants to throw off its bargain bin past and reputation to minimize the impact of AI – its sellers should follow if they want Fiverr to keep working for them.

Fiverr Branding Is Focused on Bigger, Better, and Bolder Buyers

This dip in buyer levels may partially be attributable to the strategic emphasis on brand marketing. 43.8% of Q3 2023 revenue – or $40.5 million – was funneled into sales and marketing, all focused on Fiverr’s reinvention as a place to get premium services from some of the world’s best professionals in their industries.

Sellers currently at the lower end of the marketplace by choice should be reinventing themselves, too. The platform is in a state of flux and rewarding talented sellers prepared to take the leap in all categories where there is a Pro marketplace demand.

Fiverr Pro Marketplace Growth

The Fiverr Pro marketplace is barely three months old, but it is a fully-fleshed out one, since the groundwork for it was already laid with Fiverr Business marketplace, which essentially got a rebrand in August 2023. It’s easy to dismiss this as a simple rebrand, but it’s one that is getting tens of millions of dollars thrown at it as the focus of much of Fiverr’s current activity.

This doesn’t mean the regular marketplace is disappearing, or even that it is being cannibalized. However it does mean that in the near future, Fiverr may become a two-tier marketplace. There is room for everyone, but sellers who want to get access to the best clients and projects must focus their efforts on becoming Pro Verified.

Remember, Seller Plus and Promoted Gigs are available tools. Fiverr also values sellers of every level who deliver excellence in maintaining high metrics (visible and otherwise) and good customer service. While this can be punishing to achieve consistently, the rewards are there. It’s not just about being competitive – it’s about building a sophisticated freelancing business that Fiverr recognizes as an emergent talent to work with their best buyers.

Q3 2023 Results: Fiverr’s Promise Continues to Grow for Its top clients and freelancers

Fiverr’s Q3 2023 results are good news for Fiverr’s top sellers, especially those in the Fiverr Pro or Fiverr Certified Programs. As promised by CEO Micha Kaufman in the company’s August 2023 Product Launch, Fiverr is currently highly focused on acquiring larger clients with bigger budgets – and the strategy is working:

“Today, we have exciting news to share. We are doubling down on our strategic pillars, accelerating our investment in moving upmarket, and taking on the toughest technological challenges to create beautifully simple innovative products that provide breakthrough experiences for our community. We have a track record of leveraging technology to crack tough challenges. We built the first Service-as-a-Product platform to reduce the time and complexity of hiring a freelancer online. Now we are tackling bigger projects, bigger businesses, and the most complex challenge of them all – quick, powerful, and effective matching.”

Micha Kaufman, Fiverr Co-Founder and CEO

Regular sellers may be feeling gloomier and left out of the relentless pace of the march upward that defined Q3 2023. But still, for now, the Pro marketplace acts as a complementary one to the regular marketplace. This can somewhat justify any negative feelings about the reduced focus on overall buyer acquisition by quantity. The much larger pool of sellers in the regular marketplace may suffer a bigger drop in the number of buyers and a heightening of competition as new sellers join daily.

In other words, Promoted Gigs and Seller Plus – both paid programs – will become even more important to these sellers. All sellers should focus their efforts into creating offers and a service that make them candidates for Pro, where the real progress is being made by Fiverr.

Yes, these are paid services that are helping to increase Fiverr’s take, but so much of that money is reinvested. It doesn’t make sense to point at Fiverr as driven by greed in Q3 2023. The obvious solution is to follow the trend of Fiverr and the ongoing cost of living increases by rising prices.

For established regular Level 2 and TRS sellers with a relatively stable Fiverr income and many returning buyers, all this may not mean much; their stability may feel largely unaffected by the platform’s Q3 2023 shifts. However, it is worth noting that of all the seller groups most likely to have their sales cannibalized by Fiverr Pro, it is this group, due to Fiverr’s focus on its Pro marketplace. It is never bad to repeat and remember the mantra that freelancing is a game of feast or famine.

Add the potent – and growing – threat of AI to industries across the board in Q3 2023, and it is clear that Fiverr has chosen its direction. It is now up to sellers to decide where they stand and what their future on Fiverr is. For sellers in the regular marketplace fussing about enforced price increases on gigs under $100, the platform may simply not be a welcoming environment in the coming months and years, simply because of the fundamental misalignment between these sellers and Fiverr’s core brand identities.

As 2024 opens, sellers are left feeling like the platform is at war with its livelihoods – and the backlash against the new system is making many established, upmarket sellers reconsider their decision to work on the platform.

In the end, that is the key message of the Q3 2023 Report for all sellers of Fiverr: that they, too, should aim to be bigger and bolder in the face of any existential threats that exist in their path. To ignore this call would be unwise.

UPDATE: In January 2024, sellers reacted poorly to Fiverr’s new levels and rating system, but many will find themselves accepting it after an initial period of rejection. Fiverr, it would seem, is just too irresistible to pass on by – and the company knows that. Fiverr’s Q4 2023 report shows that Fiverr’s AI gambit is paying off, and that sellers will need to adapt to thrive in this new era.

What do you think? It’s been a tough year on Fiverr for a lot of sellers, while other sellers have enjoyed their best months and years ever. Do you think Fiverr is losing the values that made it successful in the first place, alienating the very sellers that built it, or are you more in the camp where Fiverr is doing the right thing by pushing for growth in more upscale markets and dropping the limitations of the cheap and cheerful model of the past? I’d love to hear your thoughts on Q3 2023 report and 2023 in general!