Does Fiverr’s Q1 2024 financial statement indicate a company in trouble? No. Despite some challenging trends, Fiverr isn’t about to collapse into a dirty pile of AI hubris anytime soon, but sellers and investors alike should be aware of certain concerning developments.

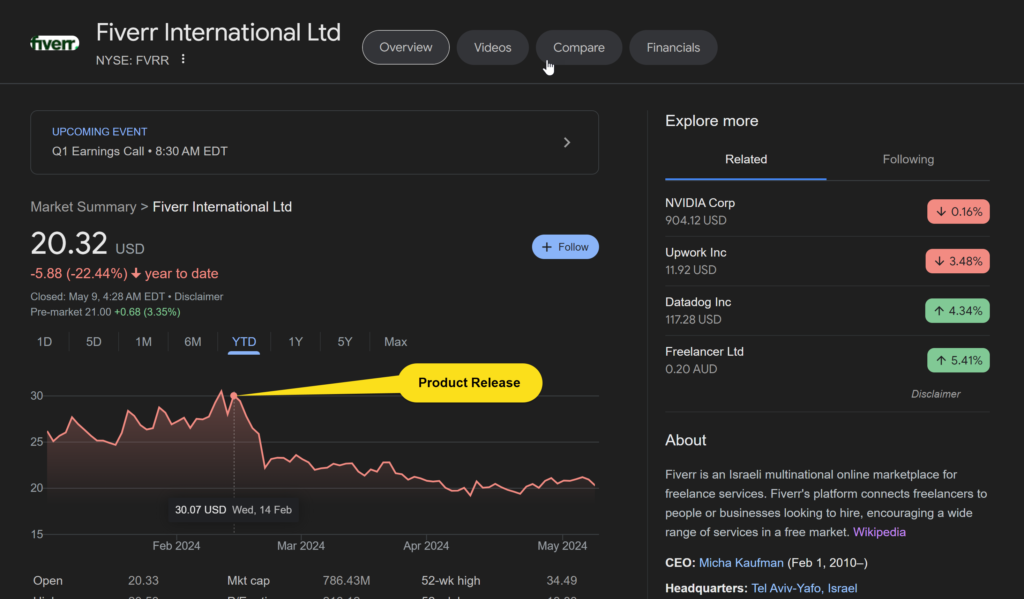

Fiverr’s Q1 2024 report has finally landed. It’s been a rough quarter for Fiverr and its sellers. It saw the stock price plummeting in February as sellers reacted to a product release that met with fierce criticism.

Today Fiverr dropped its financial reports for the first three months of 2024 (Q1). As a seller, it’s good to know what these results tell us and to analyze how the company is doing so we can adjust our strategies.

Q1 2024 has been rough for many sellers – myself included – with a Valentine’s Day massacre of seller levels and ratings kickstarting a trend of Fiverr millionaires leaving the platform. Sellers have also complained about the freelance platform’s overwhelming focus on AI, the mysteries of the all-new success score, and an apparent drop in buyer numbers.

On the other hand, some sellers are reporting their best months in sales yet. There will always be winners and losers on a platform like Fiverr, but what does Fiverr’s financial reporting tell us?

Should sellers be concerned? Is Fiverr really dying? I don’t think it’s going to die anytime soon, but there are plenty of alarm bells ringing that the company should be listening to.

Fiverr’s Q1 2024 Results Are Overall Positive

- Revenue growth: Fiverr’s revenue grew 6.3% YoY to $93.5 million – but this increase could be seen as modest

- Active buyers: Since Q1 2023, Fiverr has lost 6% of its buyers, going from 4.3 to 4.0 million – this could be a result of marketing to higher-quality buyers

- Spend Per Buyer: Buyer spending increased to $284 in Q1 2024, up 8% from $262 in Q1 2023, indicating sellers are making more money per order

- Take Rate: Seller Plus and Promoted Gigs continue to boost Fiverr’s take rate, which now stands at 32.3%

It’s definitely concerning to see Fiverr’s buyer numbers continue to slide, even with Fiverr’s positive spin suggesting that this is a result of its new upmarket strategy. There’s no doubt that this impacts opportunities for seller growth, especially at the cheaper end of the marketplace.

Still, there are 4 million active buyers on Fiverr and they are spending more. Fiverr is shifting its focus from quantity to quality, and that is reflected in its spend per buyer. At the same time, it is also increasingly focused on monetizing sellers through programs like Seller Plus and Promoted Gigs.

But will this strategy work in the long run? Shortly after Fiverr introduced its first product release of the year, Fiverr stock tumbled catastrophically – it still hasn’t recovered:

This didn’t go unnoticed by investors.

A week later, The Globe and Mail published an article investigating Fiverr’s continued stock drops, characterizing Fiverr’s sales volume as “flat”. The article also notes that if buyers continue to decrease, sellers may go with them.

That’s already happening – but we’ll get into that later.

Meanwhile, in more potential bad news for freelancers (if not Fiverr), Motley Fool – which holds a position in Fiverr – is touting Fiverr as a growth AI stock. While the numbers look positive for now, there is good cause for concern for Fiverr sellers and investors in the long run.

Where Have All The Buyers Gone?

One of the most common complaints from Fiverr sellers in Q1 2024 is the lack of orders. Some sellers have reported great sales, but the majority have self-reported dips, from sellers with a Success Score of 4 to 10.

To put it into context, I have a success score of 10. I’m a Pro-Verified, Top-Rated Seller with over 4,700 orders completed. My averag rating is 4.9. In the past, I’ve been invited to meet with Fiverr’s CEO.

I’ve made 4 sales this year.

Four.

While there are other contributing factors like being out of office for long periods of time due to sickness, I’ve never had such bad sales – or such terrible leads. I’m not giving up on Fiverr, because I know how good it can be. And besides, freelancing has always been feast or famine. Why ditch a great income source?

But it does concern me, especially when I see other top sellers with high success scores experiencing the same problem. From my personal experience fewer buyers and they are lower quality – and other sellers echo this sentiment.

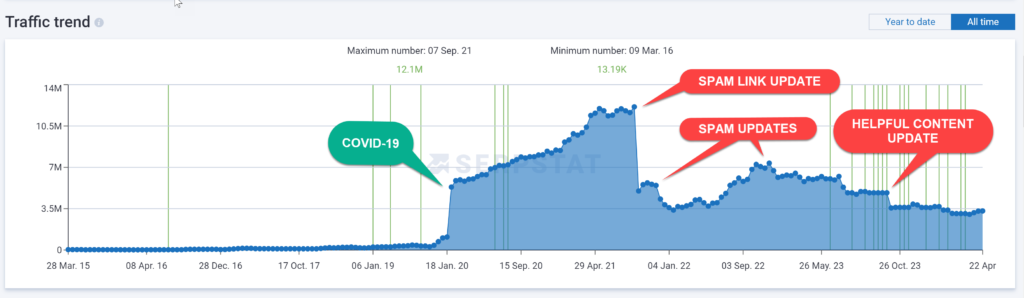

One thing that we can look at is Fiverr’s web traffic, which I investigated on Serpstat. It isn’t surprising to see that Fiverr’s traffic has declined since its “golden years” of the coronavirus pandemic, but there’s another interesting story in the graph: Fiverr’s relationship with Google.

Since 2021, Fiverr’s traffic has suffered multiple drops, many of which can be linked to Google updates:

- July 2021 link spam update

- November 2021 spam update

- October 2022 spam update

- September 2023 helpful content update

The big question that this graph cannot answer is how much of this traffic is from sellers and how much is from buyers. Fiverr doesn’t reveal how many sellers are on the platform, but it does have a big seller problem.

Fiverr Is Losing the Interest Of Its Top Sellers

Fiverr often treats its sellers like an infinite resource. There will always be new sellers to replace sellers who leave. This is concerning when Fiverr has made no bones about going upmarket.

While Fiverr’s pool of sellers may feel infinite, talent and experience are finite resources – and exactly the kind of seller that upmarket buyers who visit Fiverr want to work with for their complex projects.

But why are they leaving? There are a couple of factors.

Fiverr Sellers Feel Disregarded

In the opening to the Shareholders Letter for Q1 2024, Fiverr’s CEO wrote:

“Since moving to the semi-annual product release cycle last year, we have received very positive feedback across our community”

Micha Kaufman, Fiverr CEO

As someone who moderates r/Fiverr and frequents the official Fiverr Forum, I’m not sure where this positive feedback is coming from. The vocal community is largely unhappy and confused by the changes. Sure, there are some positive voices in the mix – but they are far and few between.

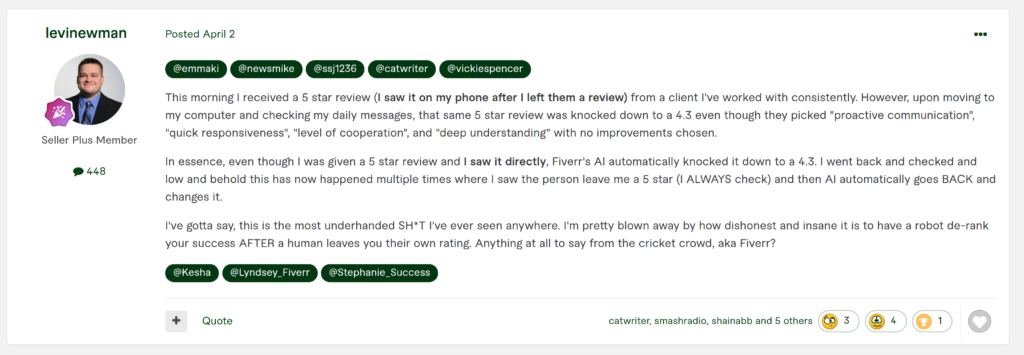

One of the more vocal opponents is Levi Newman, a Fiverr millionaire who was invited to a top-level meeting with Fiverr after threatening to quit. He is still on schedule to quit on June 1, disappointed by what he sees as Fiverr’s over-reliance on poorly-designed AI systems (login required to view thread):

This doesn’t mean that everyone is unhappy with Fiverr, but there is increasing criticism of how much pressure the platform puts on sellers’ mental health.

Your Sellers’ Mental Health Isn’t a Game, Fiverr

Some sellers are leaving Fiverr – or considering leaving Fiverr – due to their health. For many sellers, Fiverr’s metrics represent an insidiously destructive form of gamification. One former Fiverr seller, Julie Schoen, wrote of how Fiverr’s gamification caused her to hallucinate.

Fiverr is aware of these issues, as they are often mentioned by sellers – yet the product release introduced a new level of gamification, driven by AI – the success score. If you don’t work on Fiverr, it’s as simple as this: imagine having a career-making or -breaking annual performance review every day with an AI boss. In 2021, I was diagnosed with autoimmune disease; stress can be a contributing cause.

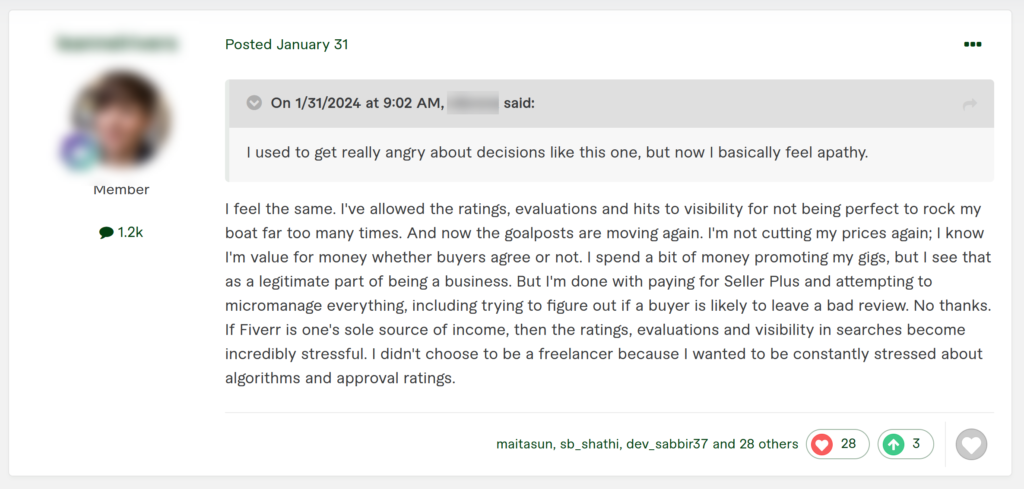

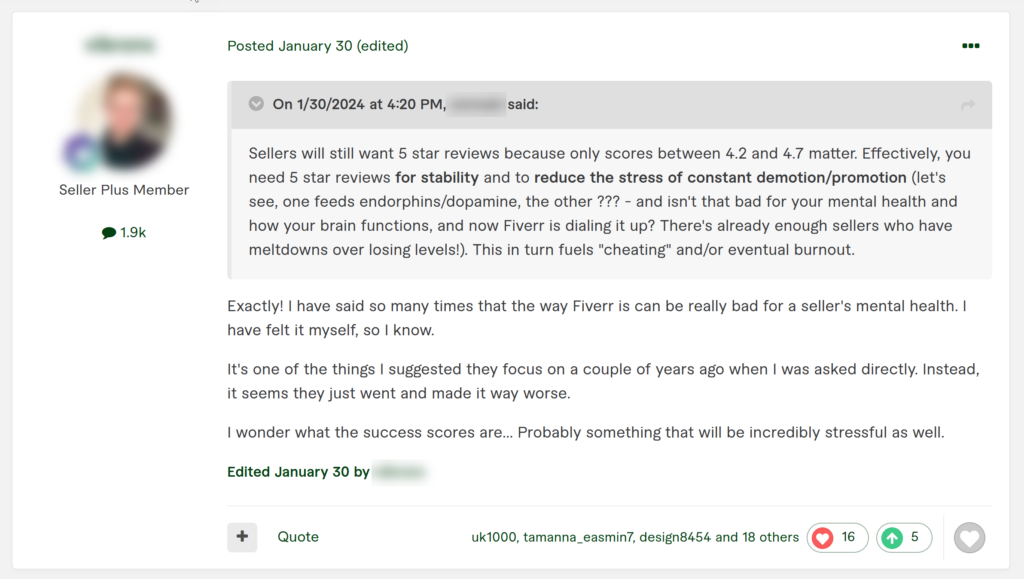

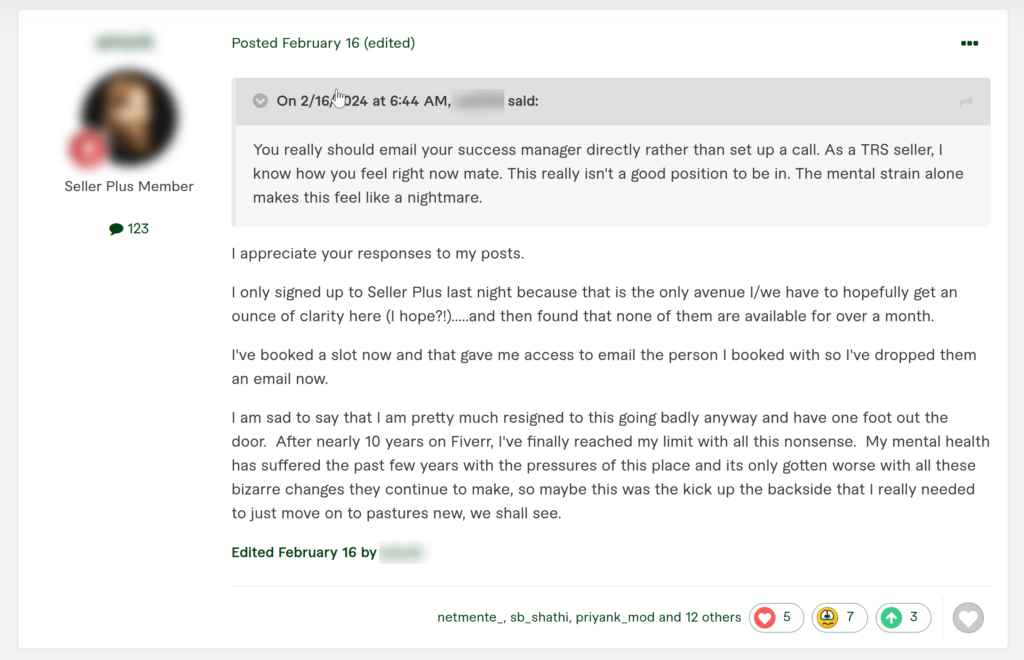

While these can be seen as outliers, there are thousands of complaints in Fiverr communities of the mental toll of stress from working on Fiverr. Below are three comments which represent the increasing apathy of long-terms sellers – and their increasing desire to move away from Fiverr due to Fiverr’s recent changes.

If sellers aren’t quitting after summit meetings with staff, they’re mentally checking out. It’s hard to square Kaufman’s commentary with what the sellers in the trenches are saying:

Fiverr doesn’t release seller numbers, so we have no way of knowing how many sellers are on the platform. However, it’s clear from community commentary that Fiverr is failing to listen. One of the biggest sub-dramas during the product release focused on Fiverr’s use of the word transparency.

Still, Fiverr has weathered these storms before: sellers often react poorly to changes, only to settle down and accept changes after adjusting. This has certainly been the case in the past – but in the past, the job-stealing AI bogeyman wasn’t lurking in the shadows.

AI May Grow Fiverr – Or Destroy It

Fiverr recognized the opportunity and the threat of generative AI early in 2023. Since then, the company has dived head-first into the area with Fiverr Neo, an AI Assistant alongside dedicated AI categories, AI marketplace governance systems, AI-focused webinars, and, more strangely, a non-disclosure AI policy for sellers who use AI in their work.

This can be justified by AI’s contribution to Fiverr’s financial performance in Q1. Demand for services like AI applications, chatbot, and MidJourney artists surged in 2023. Searches for AI services grew by 1,000% as AI-related gigs grew tenfold.

Fiverr reported that AI created a net positive impact of 4% on its business in 2023 as services shifted from the simple to the complex. Services like AI development contributed heavily to this, with average transaction sizes being 30% larger.

It’s not surprising, then, that Fiverr is investing heavily in integrating AI services across its core marketplace. However, sellers aren’t generally in favor of AI for two reasons:

- AI has wrecked lower-priced gigs in verticals like writing

- Sellers are face suspicion from buyers who don’t want AI services

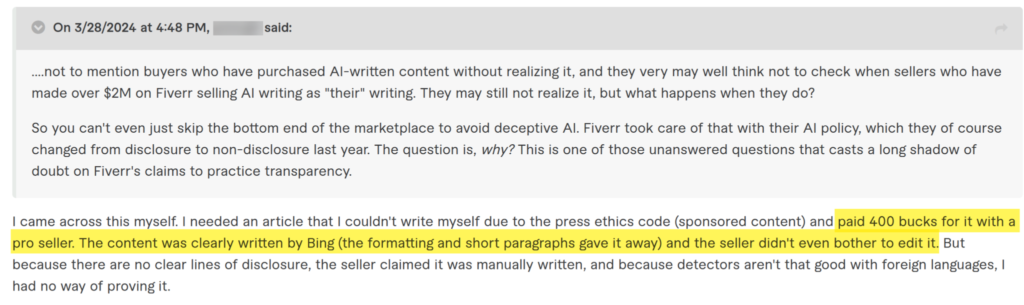

The second point is important, as it directly ties into Fiverr’s AI policy. Anyone can sell something made by AI and claim it as their own work. One buyer reported losing $400 from such a transaction:

As the saying goes, once bitten, twice shy. As platforms like Medium start pushing back against AI and concerns about AI washing in a stock market bubble come to the fore, is Fiverr’s love affair with AI really a wise move?

Fiverr’s AI Policies Have Long-Term Consequences

AI is clearly a boon for Fiverr at the moment – but how long can this last? If Fiverr becomes too dependent on AI, then future disruption or even regulation – such as the EU AI Act – may hurt its future growth. Sellers are already talking about the EU AI Act as something that could give them a break from Fiverr’s use of AI to govern the marketplace.

There’s also the growth and improvement of AI services to contend with. As AI gets more capable, some of Fiverr’s complex service providers may see a downturn in orders. This will inevitably lead to pressure on pricing and lower margins.

Finally, there’s the human element. Fiverr has a 20% commission on all orders and shows no intention of reducing this even as its take rate and average order price swells. Fiverr is a high-pressure, stressful environment; talent can and will move away from Fiverr as soon as possible. Fiverr Millionaire Alex Fasulo, who quit just a week ago, told her 100,000-strong audience, dismissed Fiverr as a “training wheels” platform.

Which brings us back to the problem: talented freelancers are a finite resource – but the asset that buyers are looking for when they come to Fiverr. Not AI. Yet AI, paradoxically, is what is driving talent away from Fiverr.

Fiverr’s AI Webinars and AI Hub Aren’t Welcomed

One place that Fiverr spends a lot of time evangelizing about AI is its own forum. In recent months, Fiverr launched its AI Hub. This hub is (regrettably, considering the amount writing talent on the platform) full of generic articles written by AI. Fiverr staff frequently post these AI Hub articles to the forum with posts that also appear to be AI.

The freelance platform’s AI webinars are not much better received. In April, Fiverr hosted a webinar which showed writers how to sell articles written by ChatGPT in such a way as to evade detection by buyers.

It’s one thing to hear this coming from a low-level Fiverr seller trying to make a quick buck. It’s quite another to see this advice approved by a platform that repeatedly underlines its commitment to marketplace integrity.

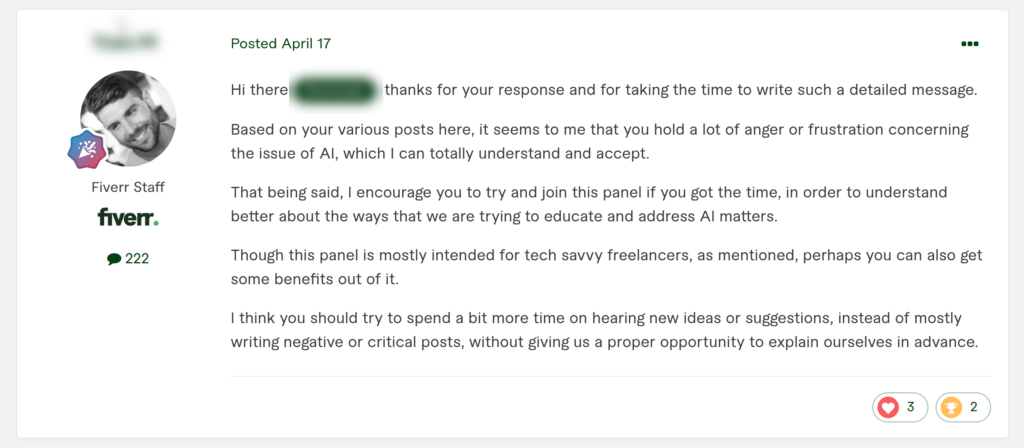

Other webinars about using AI on Fiverr have met with derision from sellers. The lack of community enthusiasm for AI on Fiverr provoked one member of Fiverr staff into telling a poster they “hold a lot of anger or frustration” about AI, before hinting that the AI Expert panel was intended for “tech savvy freelancers“.

The poster in question had focused on criticizing Fiverr’s AI policy and its potentially negative impact on consumer trust in the marketplace. They also have sell what Fiverr might loosely call a “complex service” AI gig, offering to edit, fact-check, and humanize articles written using AI.

Staff – wisely – tend not to respond to criticism in their forum, instead directing users to their frequent webinars. While comment sections are sometimes available in the webinars, they are often shut down due to political spam, leaving staff to pick softball questions with self-serving or evasive answers.

It’s hard to see where Fiverr is getting its positive feedback from; the company will also remove users from the community if their opinions prove too disruptive. While this is understandable from the perspective of a company platform, it also means Fiverr is choosing to ignore some of its most vocal critics at the press of a button.

Fiverr’s Q1 2024 Hides Some Uncomfortable Realities

A quick look at Fiverr’s Q1 2024 reporting might leave investors with the impression that Fiverr is doing well, especially in the current economic climate. However, Fiverr’s continued success depends on its most important assets: buyers and sellers.

These aren’t just assets: they are human users for whom Q1 has been a mixed bag. The modest revenue growth comes at the cost of a decrease in active buyers and an increasing focus on monetizing sellers. This does not seem like a solid foundation for sustainable growth and user satisfaction.

AI continues to be an opportunity and a threat to the platform and its sellers. Traditional freelancers may be alienated by the technology, but the opportunities are ripe for those who can offer complex services. A bigger issue is the platform’s woeful AI policy of non-disclosure which is transparently anti-consumer. Fiverr staff will complain when its users point this out, but never address the issue fully.

If sellers want to thrive on Fiverr, they need to balance Fiverr’s uneven, if ambitious application of AI technology on the platform with their own goals. Part of this is learning not to take Fiverr’s gamification so seriously; but when this is so deeply entangled with future earning potential, it’s not easy.

What is clear at this point in time is that it is still to early to see how Fiverr’s first product release of 2024 has impacted the platform. One thing that Fiverr should take forward from this is that it needs to listen more closely to its sellers, especially those with the talent to bring buyers to the platform. Without these sellers, the platform cannot hope to fully execute its upmarket strategy – and that will only lead to a disastrous implosion.