Fiverr W-9 forms don’t have to be a headache. This guide will help you get through the process of filling in your Fiverr W-9 form quickly while ensuring compliance and speeding up gig approval. Give Fiverr what they need by checking the right boxes and avoid tax and gig problems.

Having problems with your Fiverr W-9? You’re not alone. Tax can be a difficult, even scary subject for many people. Just one small mistake and the IRS could be kicking your door down. ?

Meanwhile, it feels like everyone else is twiddling their thumbs, leaving you on the hook.

Note: I am not an accountant or a tax professional – this guide is intended for general information only. If you have specific questions or issues, you should talk to a qualified professional about your situation.

The TL;DR for Busy Sellers

- It is safe to share your tax information with Fiverr

- Fiverr is required to ask for a W-9 from U.S persons

- Sellers with no associations to the U.S. don’t need to fill out the W-9

- Get all your tax information together before filling out the form

- Follow the video walkthrough in this guide

- Double-check everything before submitting to avoid delays

- Fiverr only notifies you if your form was successful

- Fiverr will send a 1099-NEC for the previous tax year each January

- Minors (sellers under 18) need to use their parent or guardian’s details

- Get specialist advice from a tax professional if you need help

- Your tax is your responsibility, not Fiverr’s

It’s Safe to Share Personal Information on Fiverr

Fiverr takes its user security seriously and has a detailed privacy policy. The website uses SSL encryption to ensure that all information transferred between your browser and Fiverr’s servers are encrypted. It is very difficult for other people to intercept SSL encryption.

Once your W-9 is filled and submitted, Fiverr will automatically turn on two-factor authentication (2FA) for your next login, adding a new layer of security to your account. 2FA means you need a code (usually from an authentication app) on top of your password.

Fiverr is also a public company (NASDAQ:FVRR), which means it adheres to strict regulatory standards. This includes the secure storage of sensitive information, regular security audits, and strict access controls. Only authorized personnel can access your data.

Beyond this, it will only collect necessary data and share it when necessary. In this case, they will share your data with the Inland Revenue Service (IRS) as required by U.S. federal law.

Where Do I Find the W-9 Form for Fiverr?

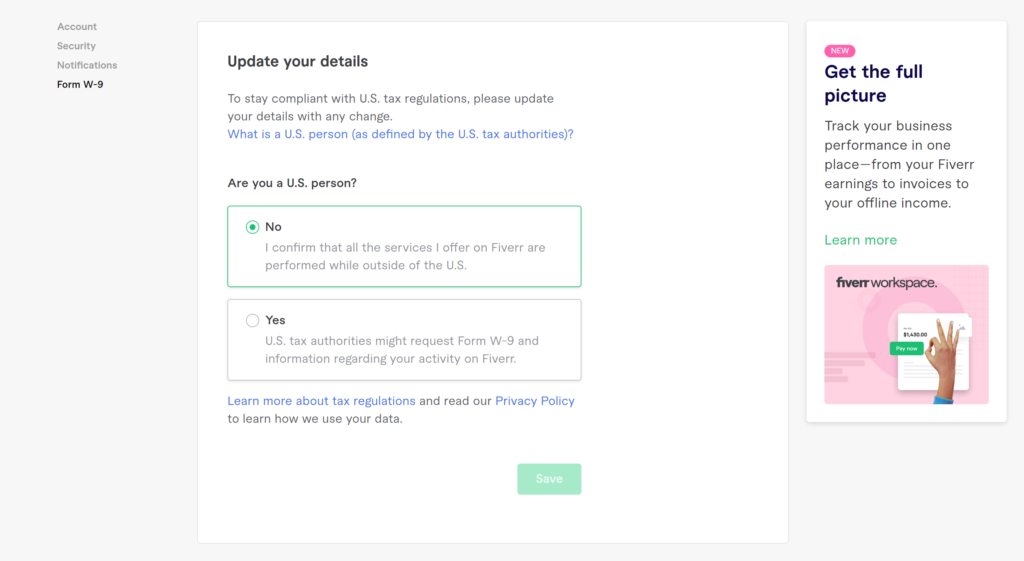

Click on your profile image (top-right corner), click on settings, then click on Form W-9. You’ll find yourself on the page below. Click yes to get started.

Clicking yes will take you through to a secure online W-9 form.

If you are not a U.S. Person as defined by the IRS, just click no. You will not need to do anything else with this form, but please check your local tax obligations to make sure you are in compliance.

Be Careful with the Definition of a U.S. Person

A “U.S. person” is not just someone who is a citizen or resident of the United States. According to the IRS, it also covers other types of “person”:

- Domestic partnerships

- Domestic corporations

- All estate types (excluding foreign estates)

- Trusts where a U.S. court can exercise primary supervision over the administration of the trust and one (or more) United States persons have the authority to control all the substantial decisions of the trust

- Any other person who is not a foreign person

What is a foreign person? According to the IRS,

- Nonresident legal individuals

- Foreign corporations

- Foreign partnerships

- Foreign trusts

- Foreign estates

- Any other person that is not a U.S. person.

If you are not sure about your status, consult a tax professional. This is especially important if you are a United States citizen living abroad or were born in the United States but have never lived there, as you may be subject to double taxation.

How Long Does Fiverr Take to Review Your W-9 Form?

If you’re waiting on your W-9 approval from Fiverr, then you’re not alone.

Unfortunately, there’s no simple answer here. Sellers have reported anywhere between a few seconds, a few days, or – in the worst case – a few weeks. If your W-9 submission is taking longer than expected, contact Fiverr’s Customer Support team.

Fiverr must collect W-9 information from sellers whom the US define as a “U.S. person” W-9. This is a legal requirement that must be fulfilled within 30 days of Fiverr’s request. If 30 days pass without submitting your W-9 information, your gigs will be paused until you complete the form.

If this is your first time filling out this form (or you’re not sure what to write), contact your accountant, financial advisor, or another qualified professional.

Why Fiverr Freelancers Need to Fill Out the W-9

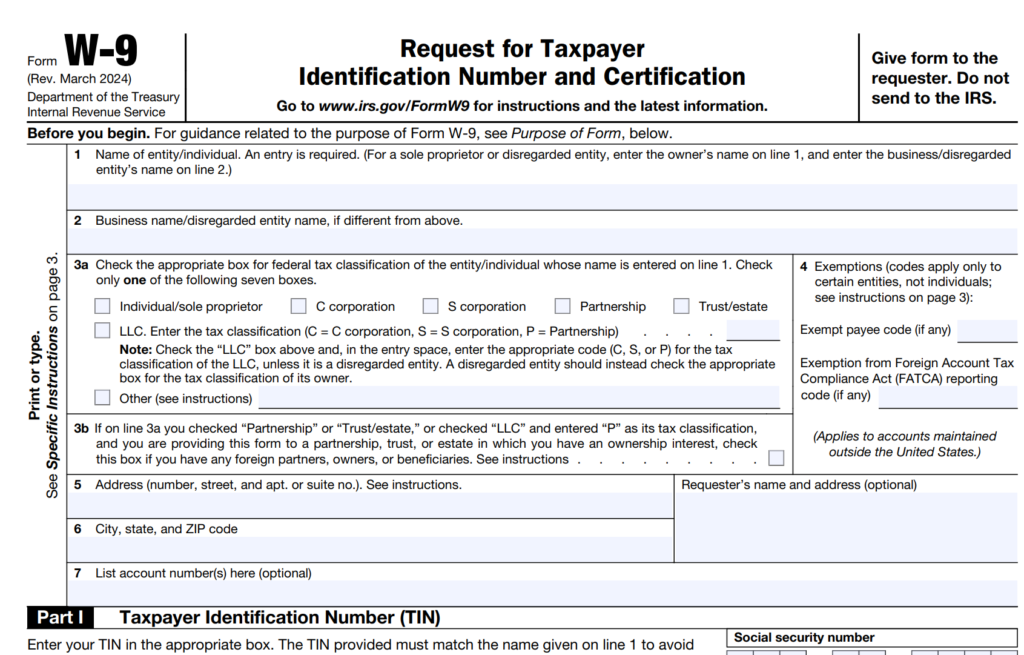

The W-9 form is a request from the Internal Revenue Service (IRS) for your Taxpayer Identification Number (TIN) and Certification. It must be provided on request to clients and freelance platforms like Fiverr when asked. The requester needs it for their own tax forms, like the 1099-NEC.

You may not be asked for the W-9 immediately, but as your total payments from Fiverr approach $600, you should expect the request to come through. The 1099-NEC form is used by business (in this case, Fiverr) to report payments over $600 made to nonemployees, ensuring the IRS’ awareness of freelancing income from various clients over the tax year.

The income reported by Fiverr on the 1099-NEC represents taxable income that must be included on your tax returns. Freelancers must report their income accurately to avoid potential penalties from the IRS.

All sellers on Fiverr are working as independent contractors (freelancers). Unlike full-time employees, you do not receive benefits like a 401k contribution match or health insurance, but you can claim deductions on work expenses and your home office. What you can claim depends on your specific work – discuss this with your accountant.

How to Fill Out a W-9 on Fiverr

You will be asked to fill out your W-9 form for Fiverr using a secure online form on its website. You’ll be asked to fill out some key business details:

- Your legal name (the name on your tax return)

- Your business entity (e.g. sole proprietorship)

- Details of your type of business

- Details of exemptions (e.g. FATCA reporting)

- Your TIN type (if you have an SSN and a EIN, use the EIN)

- Signature and date

If you’re not sure what to write in boxes 2 and 3, here is some guidance:

| Sole Proprietor / Single-Member LLC | Partnership, Multi-Member LLC, Corporation |

|---|---|

| Your name | Business, trade, or DBA name |

| Legal business name | Business, trade, or DBA name |

| Use your home address or address of the place where you do your Fiverr business | Use your business address. If you have formed an LLC, use the correct letter for your LLC tax classification (3) |

You can also follow this video tutorial from a certified public accountant, Navi Maraj. This video features specific walkthroughs for different types of business entity, including sole proprietors, LLCs, and partnerships:

How You Know Your Fiverr W-9 Was Successful

Fiverr will let you know if your W-9 was successful, sending you an email, a top banner notification, and what it describes as a “pin flash”.

If you’re not successful, then you’ll be left in a limbo. Unfortunately, the onus will be on you to contact Customer Support to find out what is happening.

Best Practices for Submitting the W-9 Form on Fiverr

As soon as Fiverr sends a W-9 request, you have 30 days to submit before your gigs are paused and removed from the listings. It’s best to get it done as quickly as possible so that if any mistakes or delays happen, you have time to fix things without losing your momentum on Fiverr.

- If you’re not confident about filling this out, ask for help from a finance professional.

- Take time to collect all your financial information before you fill out the form and set aside some quiet time. It won’t take long to fill out, but you will want to concentrate and avoid distractions.

- You can use the information on your personal tax return or your business tax return as a reference.

- Take care to fill out the details correctly – the table above explains how to fill out the form depending on your status as a sole proprietor or as a business entity.

- Read the form carefully, fill out the W-9 form accurately, and double-check your entries for mistakes.

- Always use your EIN if you have an EIN and an SSN. If you don’t have an EIN, the SSN is fine.

- Once you’ve done a final check of everything, sign and date your W-9 and return it to Fiverr.

The whole process should take no longer than 10 minutes. If you get everything right, you should be approved in a few short minutes.

After Submitting the W-9

You won’t need to do anything else unless important details about your business change in the future. Fiverr will let you know if you submission was successful. Fiverr will send you a 1099-NEC for the previous tax year in January of the following year. For example, in January 2024, you would have received your 1099-NEC for 2023).

Keep Your W-9 Updated

You should take care to update your W-9 when your business details change. These details include things like:

- A change in legal name

- A change in business name

- A change in your Taxpayer Identification Number (TIN)

- A change in your business structure

- A change in your address

It’s best to update Fiverr and any other current clients with these changes as soon as possible using a secure channel. You can do this on Fiverr by visiting the W-9 page or contacting Fiverr’s Customer Support if you have any issues.

It’s good practice to review your W-9 information each year to make sure your details are accurate and reflect your tax situation. This simple practice helps you to ensure tax compliance and avoid backup withholding or incorrect income reporting issues.

Fiverr W-9 Troubleshooting

If you’re lucky, your W-9 was accepted almost immediately and you’re free to continue on your Fiverr journey. If you’re not so lucky and it has been a few days with no update, you need to talk to Fiverr’s Customer Support team. Don’t share your personal details with them!

W-9 for Minors on Fiverr

The IRS doesn’t have an age limit for the W-9 form – Uncle Sam wants his share no matter how old you are. However, federal, state and local laws have specific child labor laws and regulations you will need to follow. Because Fiverr works through contracts – and minors do not have the legal capacity to sign contracts – the W-9 gets a little more complicated.

Fiverr requires minors to sign up under a parent or legal guardian’s name, so the W-9 will need to be filled out with their tax information as your Fiverr income will be considered a part of your parent or legal guardian’s tax filings.

Again, it’s best to talk to a qualified tax professional to make sure that everything is filled out correctly. In some cases, there may be tax benefits available, such as contributing to a Roth IRA on your behalf.

W-9s on Fiverr Aren’t Complicated

Filling out tax forms is never going to win any prizes for being a fun activity, but the W-9 – thankfully – isn’t a complicated form. If you’re a freelancer based in the United States, they’re a normal part of your business activities.

Fiverr has made the process as easy as possible by providing an online form and sending a 1099-NEC every January. Unless your tax information changes, you don’t really need to do anything else.

All you really need to do is find a quiet 10 minutes to fill in your Fiverr W-9 form. Take care to make sure all your details are accurate, consult a professional if you need to, and click the submit button when you’re ready.

Useful Resources

Your best resource here will be a tax professional who is familiar with freelance income and tax regulations. Fiverr is not responsible for your tax filings. It acts as a marketplace connecting freelancers with clients and facilitates transactions.

- What is a W-9? (Fiverr)

- Fiverr Customer Support (Fiverr)

- Information About Form W-9 (IRS)

- W-9 Collection on Fiverr (Fiverr)

- Checklist for Completing IRS Tax Forms W-8 and W-9 (JP Morgan)